In the previous blog posts “Who Oversees Flood Control for Montgomery County?” we noted that, unfortunately, there’s not a single entity that is in charge of flood planning and flood management for all of Montgomery County. Just as significant—there’s no dedicated funding to pay for regional projects that benefit the county as a whole.

We also discussed how, throughout its existence, in addition to providing water supply and other similar services, the San Jacinto River Authority (SJRA) has engaged in planning efforts related to flooding; however county-wide flood mitigation plans have not been realized for a number of reasons, including a lack of a dedicated funding source and no broad consensus to implement county-wide flood mitigation plans. Voters had an opportunity to change the direction of flood management in Montgomery County when the creation of a Montgomery County Flood Control District was presented to them in the 1980s.

Part Three of our blog series details SJRA’s efforts in this attempt to develop a flood control district.

During SJRA’s first decades, the Board of Directors actively managed the affairs of the Authority, developed and updated a Master Plan Report including proposed improvements (https://www.sjra.net/about/history/), and looked to the future of water supply. Board meeting records from the early 1980s show the board began to turn its attention to establishing a flood control district in its home base of Montgomery County. These efforts ultimately failed when the Montgomery County voters defeated the establishment of the district and its recommended funding mechanism—a $0.01 county-wide sales tax.

A Montgomery County Flood Control District created as a separate entity, confirmed by the voters, and funded with a sales tax, could have provided the funding support SJRA and other entities needed for the design and construction of flood control facilities throughout the county.

Summaries of activities according to SJRA Board meeting records

February 24, 1983: Proposal of a Flood Control Program

SJRA Board of Directors received a presentation from State Representative Rodney Tow regarding a flood control program for Montgomery County. Representative Tow proposed that funding for future projects would have to be developed to meet this need. Representative Tow suggested a “Flood Control Division” could be created within SJRA funded by the levy of a one percent sales tax within the Authority’s boundaries. According to Tow’s proposal, the proceeds would go into a special trust fund and only the interest from the fund would be used by the Authority for flood projects. The tax would require a local option vote and could be placed on the November election ballot. The SJRA Board acknowledged the need for a flood control plan within the boundaries of the Authority and determined that if the voters of the area approved a tax for such purpose, the Authority would accept the responsibility for creation of a flood control division to conduct a flood control program.

March 31, 1983: A bill is introduced in the Texas Legislature to create the funding mechanism

The Board received an update that Representative Tow had introduced a bill in the Texas Legislature establishing the “San Jacinto River Authority Flood Control Fund” to be used for the purpose of controlling, preserving, and storing the waters of the San Jacinto River within the boundaries of the Authority. The “Flood Control Fund” would be funded by the levy of a one percent sales tax by the Authority subject to an election and approval by the voters within SJRA boundaries. After reviewing the bill, the SJRA Board of Directors reaffirmed its intention to assume responsibility as the agency to conduct a flood control plan and program if the voters in the area approved funding.

April 26, 1983: Public meetings held

SJRA Board of Directors received an update on the status of the legislation before the Texas Legislature. They were informed by staff that various public meetings had been held throughout the watershed area of the Authority and that the counties of Grimes, Waller, and Walker had indicated opposition to the levy of a one percent sales and use tax. This development prompted Representative Tow to state that the bill should be amended to establish a subdivision of the Authority to administer the program and levy the tax in such areas that desire a flood control program. Discussion was held regarding the content of the proposed bill, and recommendations were made regarding changes.

May 31, 1983: House Bill 2427 passes without the funding mechanism

The SJRA Board received a report that the proposed legislation, in the form of House Bill 2427, had passed the House as well as the Senate but with the one percent sales tax deleted. The Board appointed a committee to meet with Representative Tow and undertake whatever actions were necessary to represent the Authority and work toward the development of a flood control program pursuant to the legislation.

July 26, 1983: How can the program get funded?

It was reported to the SJRA Board of Directors that the committee appointed at the May 31, 1983, meeting had met with Representative Tow and reached an agreement whereby 1) the Authority would make no attempt to call an election nor appoint a board for the flood control district until a satisfactory method of funding had been established; 2) operations of the district would not take effect until successful elections had been held; and 3) if suitable legislation for funding is not implemented before the close of the 1985 session of the legislature, Representative Tow would work for dissolution of the flood control district in favor of a more workable flood control program. It was determined by the SJRA Board that a letter should be written requesting an attorney general’s ruling on H.B. 2427, specifically whether the bill allowed a one percent sales tax to be imposed without voter approval, due to the provision for the tax being deleted from the election ballot by the Senate.

September 27, 1983: A sales tax is revisited

It was discussed at the September Board Meeting that letters were sent to the attorney general from the SJRA as well as Senator Grant Jones requesting an AG opinion on H.B. 2427. The SJRA Board was informed that that the Authority’s questions would be added to Senator Jones’ request. Additionally, a brief was filed on September 9, 1983 on behalf of the Texas Association of Counties taking the position that the Montgomery County Flood Control District has clear statutory and constitutional authority to levy a sales tax under the provisions of H.B. 2427.

February 28, 1984: Bill to be withdrawn if no funding is provided

It was reported to the SJRA Board of Directors that Representative Tow indicated via letter that if adequate funding was not provided by the end of the 1985 session, the legislation would be withdrawn.

April 24, 1984: Efforts stalled

Representative Tow stated to the SJRA Board of Directors he felt the flood control district as previously proposed was now a dead issue due to funding issues, but he hoped to work with the Authority to find other sources of money for control of flood problems. The Board deferred any official action until further information was received from pending water resource feasibility studies of the San Jacinto River basin.

May 22, 1984: An ad valorem tax is proposed

In reference to Representative Tow’s remarks at the previous SJRA Board of Directors meeting, SJRA staff recommended to the Board that flood control activities within Authority boundaries should be the responsibility of and under the supervision of the Authority, with funding to be achieved from the levy of ad valorem taxes rather than a sales tax—a method of acquiring adequate funds to properly finance a large scale flood control program used by existing flood control authorities around the state. It was determined that statutory changes would be required to provide the Authority with both flood control and taxing authority. The Board requested an outline of suggested statutory changes be prepared and that necessary steps required to implement the entire program be developed.

July 24, 1984: Attorney General says Montgomery County Flood Control District creation is subject to voter approval and imposition of a sales tax

SJRA staff and Board discussed a June 18 opinion by the Attorney General of Texas that sustained the validity of the statute creating the Montgomery County Flood Control District subject only to approval at an election to be called by the Authority confirming the creation of the District and authorizing the imposition of a sales tax. This opinion served to revive the issue that was previously considered inactive. It was determined that the SJRA was obligated to call an election for the creation of the proposed district within two years of the effective date of the statute—prior to the end of August, 1985. The Board tentatively set the election date for the first Saturday in April 1985.

February 26, 1985: Election date set

The SJRA Board of Directors was advised by Authority legal counsel that the election date in April would not be feasible and that an August election would possibly have a greater voter turnout. The Board declared its intention to call an election within Montgomery County on the quarterly general election date of August 10, 1985, to determine whether the Montgomery County Flood Control District should be established and funded by a one percent sales tax.

April 23, 1985: SJRA Board adopted a formal resolution regarding the calling of the election.

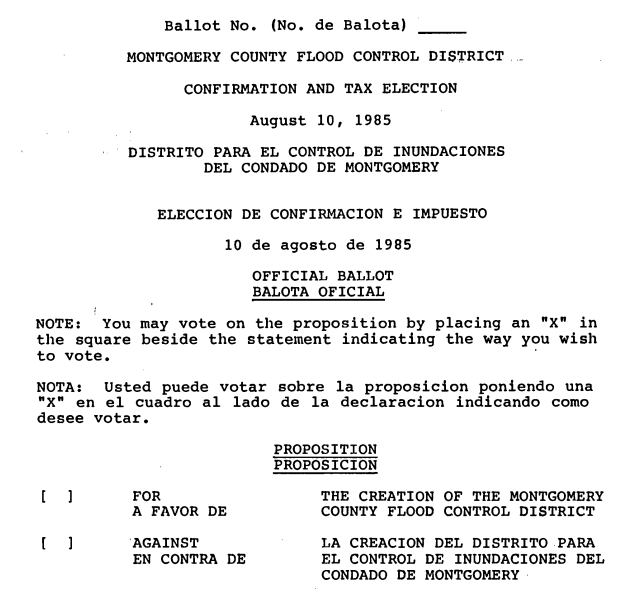

July 3, 1985: The SJRA Board adopted an order calling for a “Confirmation and Tax Election” for the proposed Montgomery County Flood Control District. The order included the following proposition for consideration:

Figure 1-Election Ballot Language (from 07/03/1985 SJRA BOD Meeting Minutes)

“SHALL THE CREATION OF THE MONTGOMERY COUNTY FLOOD CONTROL DISTRICT BE CONFIRMED, AND SHALL THE BOARD OF DIRECTORS OF SAID DISTRICT BE AUTHORIZED TO LEVY, COLLECT, AND IMPOSE A SALES, EXCISE AND USE TAX FOR THE BENEFIT OF SAID DISTRICT EQUAL TO ONE PERCENT (1%) OF THE RECEIPTS FROM THE SALE OF TAXABLE ITEMS AND THE SAME RATE ON THE STORAGE, USE OR CONSUMPTION OF TAXABLE ITEMS PURCHASED, LEASED, OR RENTED FROM ANY RETAILER WITHIN THE DISTRICT, ALL AS AUTHORIZED BY H.B. NO. 2427, CHAPTER 358, ACTS OF THE 68TH TEXAS LEGISLATURE, REGULAR SESSION, 1983, AND BY THE CONSTITUTION AND LAWS OF THE STATE OF TEXAS?”

What will voters say?

August 5, 1985: No support from Montgomery County Commissioners Court

A motion was made at the Commissioners’ Court of Montgomery County, Texas to adopt a resolution reaffirming support of the Montgomery County Flood Control District to be funded by a one percent sales tax. There was no second for the motion, and the motion failed.

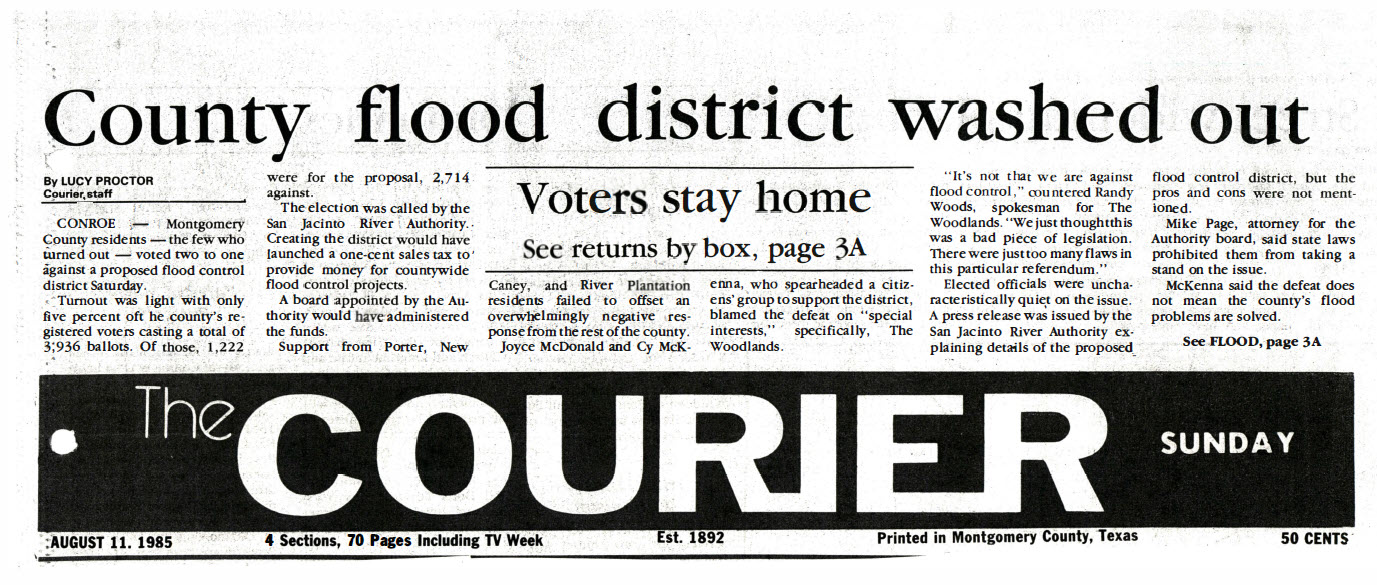

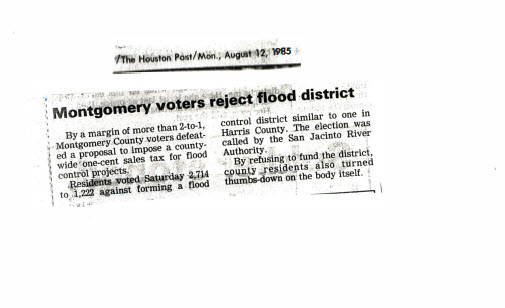

August 10, 1985: Montgomery County voters reject a Flood Control District and the $0.01 county-wide sales tax

Montgomery County Flood Control District Confirmation and Tax Election was held. The ballot measure failed by 1492 votes.

August 12, 1985: With SJRA prohibited from calling another election, who will step up?

The SJRA Board received, canvassed, and declared the official returns and results of the election. The Board determined and declared that the proposition to create the Montgomery County Flood Control District had been defeated and the sales and use tax not adopted.

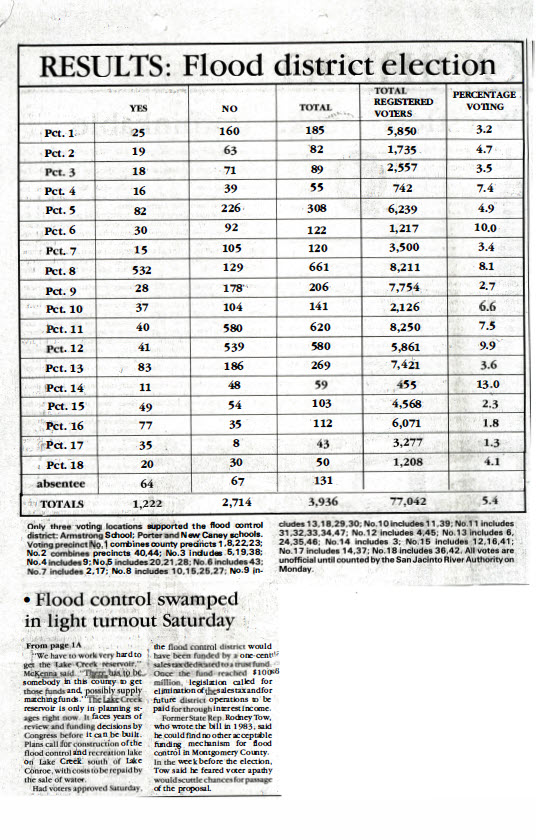

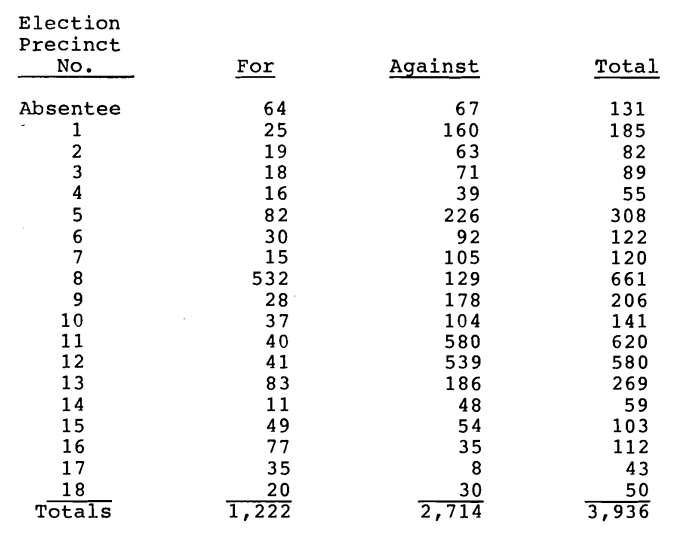

Figure 2-Election Results (from 08/12/1985 SJRA BOD Meeting Minutes)

The Board adopted a resolution ordering canvass of returns and declaring the results of the election. The results of the election were 1,222 votes for and 2,714 votes against creating the flood control district and funding mechanism (a total of 3,936 votes). The Board was informed another election could not be called within the next twelve months and that an entity other than SJRA would be required to furnish funds for the calling and holding of the election. Additionally, it was noted that the bill associated with the proposed district stipulated that if the district, together with the sales tax, was not created within three years following enactment of the legislation, the act would expire by its own terms.

Despite the election results, it was noted that the Authority recognized the need for flood control in Montgomery County and that it would support any appropriate move for the creation of a new entity, or utilization of an existing entity, for the purpose of flood planning and control in the area served by the Authority. No entity stepped up to create a new flood planning and control district or call for call for another election. The legislation expired.

Had a Montgomery County Flood Control District independent of SJRA and the one percent sales tax funding mechanism been approved, the action would have established a base operating budget for the district of approximately $10 million per year in late 1980s/early 1990s dollars (per Conroe Chamber of Commerce sales data previously obtained by SJRA). In order to account for inflation, as well as rapid growth in Montgomery County, this operating budget would likely be substantially higher in 2019.